Page 1

Loading page ...

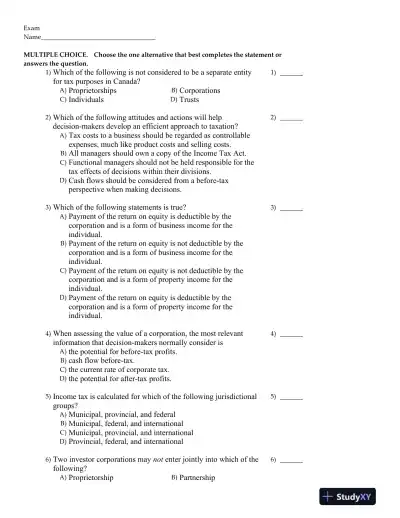

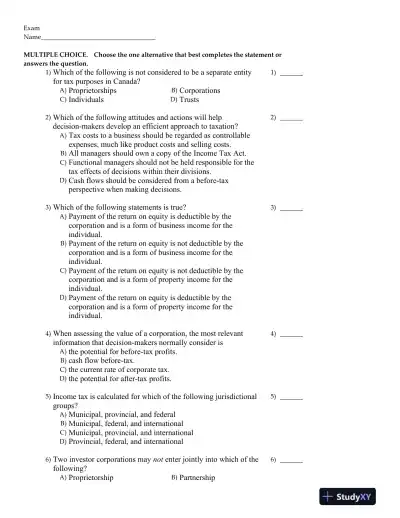

Canadian Income Taxation 2016/2017 Edition Test Bank ensures a smooth preparation journey with concise summaries, past questions, and step-by-step solutions.

Loading page ...

This document has 139 pages. Sign in to access the full document!