Page 1

Loading page ...

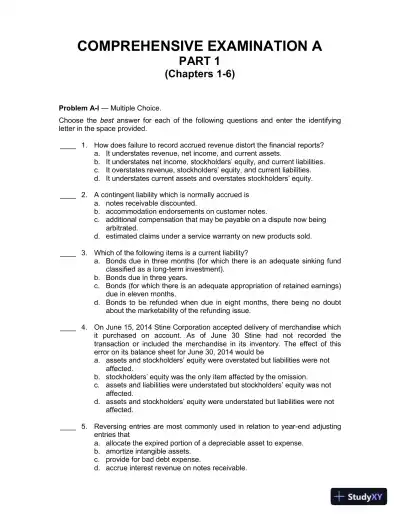

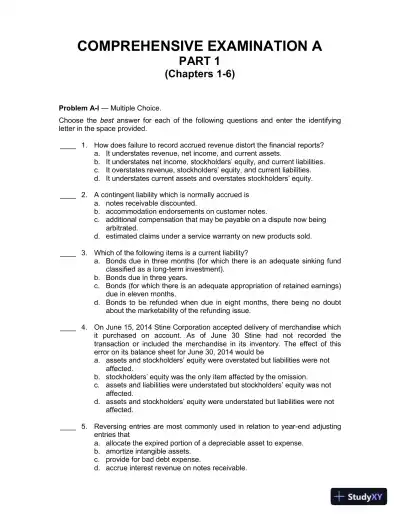

Get ready for the exam with Test Bank For Intermediate Accounting, 15th Edition, a resourceful guide featuring solved test questions for practice.

Loading page ...

This document has 1193 pages. Sign in to access the full document!